You are getting laid off. Those are words no one wants to hear. Your job, for one reason or another, is going away. It could be that that you are simply shown the door, or you are given some time before it ends. In my case, I’ve been given thirty days, and a severance package. So I know I’m lucky on that instance and not everyone is so fortunate.

It’s a tough thing to not be able to provide, and it’s something that can affect us men deeply. Providing for our families is just innate and a deeply seated need, a part of our psyche, and this loss can really send men into a downward spiral. Depression, uncertainty, and even fear of the future are common, and to some degree, expected.

To combat this, I suggest three things. First off, a faith in God. He knows what you are going through, and He provides. Place your trust in Him. The Bible reminds us several times that God knows when even a sparrow dies, and that we have much greater value. I also like this passage, as it reminds us that He does indeed provide, and not to worry.

Mat 6:28-34: And why do you worry about clothes? See how the flowers of the field grow. They do not labor or spin. Yet I tell you that not even Solomon in all his splendor was dressed like one of these. If that is how God clothes the grass of the field, which is here today and tomorrow is thrown into the fire, will he not much more clothe you—you of little faith? So do not worry, saying, ‘What shall we eat?’ or ‘What shall we drink?’ or ‘What shall we wear?’ For the pagans run after all these things, and your heavenly Father knows that you need them. But seek first his kingdom and his righteousness, and all these things will be given to you as well. Therefore do not worry about tomorrow, for tomorrow will worry about itself. Each day has enough trouble of its own.

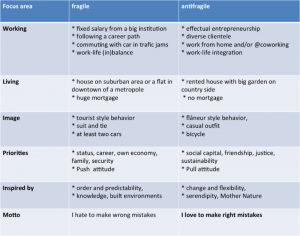

My second suggestion is to become anti-fragile. For those who are new to the concept, fragility is when all of your eggs are in a single basket. For instance, when all your income comes from a single job. The fact that your single job could go away in an instant, even through no fault or action of your own, makes you fragile. This is a scary place to be, as anyone who has suddenly lost a job knows well. Because you were fragile, you now face an uncertain future where everything depends upon you quickly getting a similar job with similar pay. If you don’t get it quickly, your savings and credit will quickly run out.

My second suggestion is to become anti-fragile. For those who are new to the concept, fragility is when all of your eggs are in a single basket. For instance, when all your income comes from a single job. The fact that your single job could go away in an instant, even through no fault or action of your own, makes you fragile. This is a scary place to be, as anyone who has suddenly lost a job knows well. Because you were fragile, you now face an uncertain future where everything depends upon you quickly getting a similar job with similar pay. If you don’t get it quickly, your savings and credit will quickly run out.

But if you have multiple income streams, then while the loss of a single income may be a big blow, it doesn’t need to destroy what you have worked so hard to build. So put in the footwork to become anti-fragile. Find another way to bring in additional income. There are plenty of ways to do this, and it’s limited only by your imagination and talent. Ebay and Amazon are popular ways to sell or resell products. Etsy is a market place specifically for handmade or vintage goods. Perhaps you have a hobby, making things which you might be able to monetize. Personally, I have fallen back on pizza delivery numerous times for extra income. Find something. Anything. The simple presence of an alternate income stream is of great comfort at a time like this.

Thirdly, and this one is far too late once you’ve been laid off, but start paying off bills and reduce what you pay out each month on things that don’t matter. The less money that has to go out each month, the easier it will be to survive between primary jobs. If you have rent/mortgage, two car payments, insurance, phones, student loans, utilities, and cable, you could easily be out $4,000 a month, before you even get to things like food. Get those loans paid off, reduce your cable bill, lower your phone plan if possible. $500 a week could cover you, if you have no other bills beyond housing and utilities, and that’s not that hard to get. It also makes that alternate income stream a possible primary income stream.

If you aren’t already affected with job loss, start with steps 1 & 3. If you are currently affected by a job loss, start with 1 & 2, but also make sure to reduce those unnecessary expenses like phone and cable. You will pull through. It may take some time, but you will. Just keep at it.

4.5

Antifragile is more than just one source of income, though that is the usual source of the fragility for most people.

The big problem is normally systemic. They live in a high cost area with high wages, but end up with trouble saving because the high wages come with high taxes, and what is left over is too expensive.

The first question, which may take a long time to answer, is where can I go so that I can pursue a full life and start saving. You don’t have to move immediately or even prepare in earnest, but it needs to be a goal. Can you do better in small town rural areas where they aren’t eroding your values daily?

Do you really need all that space? Can some things go into storage (or ebay, the chariy store or the trash?). Can you downsize?

What assumptions are you making – do you need wages from a company in the expansive area, or can you freelance from nowheresville where the rents are 1/4 and you could tread water by working as a clerk at a local store?

Plan for a few months, then select one and for that month act like you ARE laid off with regards to spending. No Starbucks (or Dunkin Donuts). Look at places hiring and the wages they pay. Think of it as a dry run. What bills? Do you have a low-interest credit card from a credit union or something similar already set up ($22,000 in debt with $20,000 in the bank is very different than debt free with $2000 in the bank – another aspect of being anti-fragile; you may have an IRA or 401k but a credit line will allow you to not have to cash those in)..

Another aspect of anti-fragility is prepping, not just for disasters, but for this exact thing. If you lose your job, you can live without HBO for 6 months. You can give up the season ticket and park the boat. But you can’t live without food, and it’s not getting any cheaper. If while times are good you stock a robust pantry, plant a big garden, buy a side of beef instead of getting it by the pound on styrofoam, your kids will eat. You may need to work two shifts a day on a newspaper press so you don’t lost the mortgage, but the kids will eat. You may spend every free hour on your knees begging the Most High for direction and a break, but the kids will eat. Your kids eating will go a long way toward avoiding the depression, the helplessness, that comes from being a provider currently unable to provide.

Do not be anxious about anything, but in everything, by prayer and petition, with thanksgiving, present your requests to God. And the peace of God, which transcends all understanding, will guard your hearts and your minds in Christ Jesus.

–Philippians 4:6-7 (NIV)

Yeah, the concept of Antifragile needs to be explored more thoroughly here. This article wasn’t really intended for that, but to introduce the overall concept and the some of the things to ease going through a job loss. Obviously, the sooner you start in, the better,and waiting until you are out of a job is not ideal by any means.

Hopefully we will get an article that goes into more detail up soon.

5